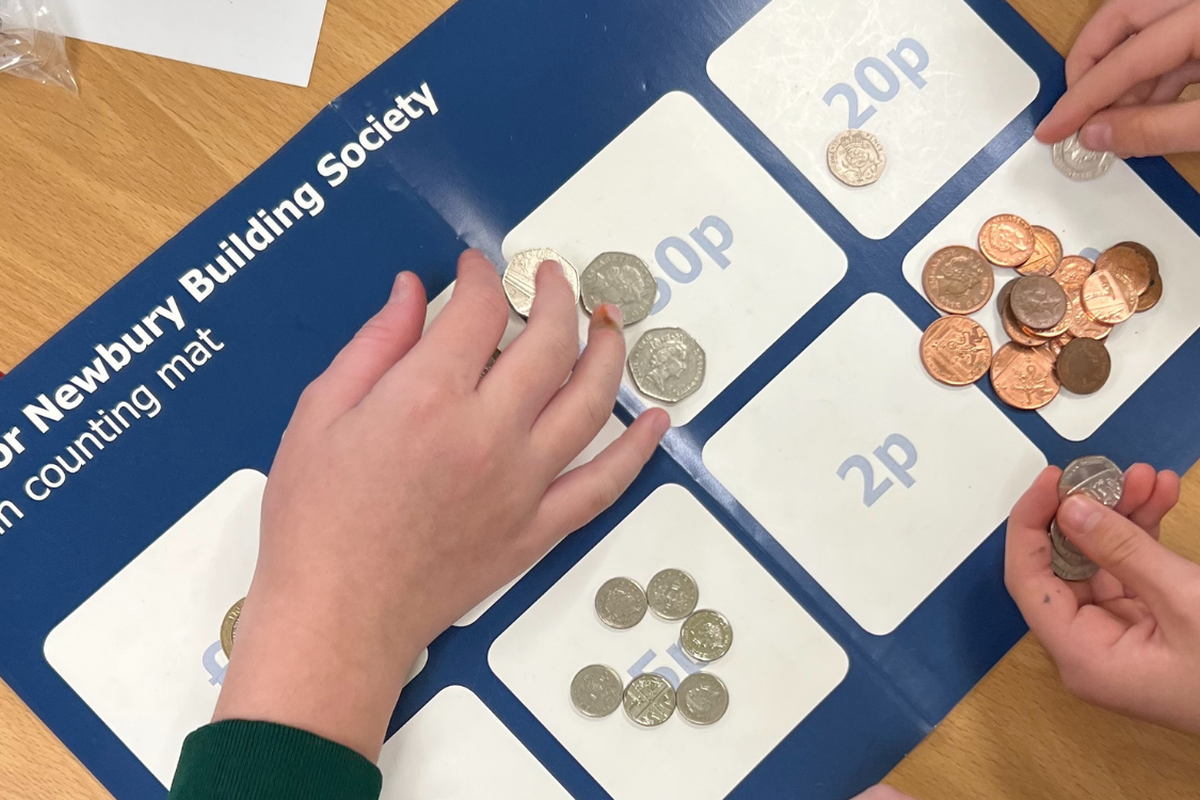

Start saving for their future today.

Funding their dreams starts here. Whether you’re a parent, grandparent, or guardian, you can begin building a nest egg for their future. Or, if you’re a teenager, why not start saving for yourself?

Our children’s savings options

- Young Saver - easy access account – flexibility to deposit and withdraw funds when needed

- Junior Cash ISA (JISA) – tax-free savings that can’t be withdrawn until they turn 18, helping secure their financial future

Why choose us?

- Trusted savings solutions for families and young savers

- Competitive interest rates

- Simple application process

Eligibility:

We accept savings applications from new members and existing members living in England or Wales.

Explore our junior accounts below, book an appointment or visit us in branch to discuss starting savings plans today.

Book a savings appointment online now

Appointments are available by video call, phone and in branch.

"Great customer service, friendly and helpful. Glad we chose to open a child account with you."

You're protected up to £120,000

Your eligible deposits with Newbury Building Society are protected up to a total of £120,000 by the Financial Services Compensation Scheme (FSCS), the UK's deposit guarantee scheme.

Need some help?

Book a savings appointment

Appointments can take place in branch, over the phone, or from the comfort of your own sofa on a video call.

Contact us

Call, email, or request a call back from a member of our team.

Visit your local branch

Pop in to one of our ten friendly branches - we'd love to see you!